The following information pertains to questions

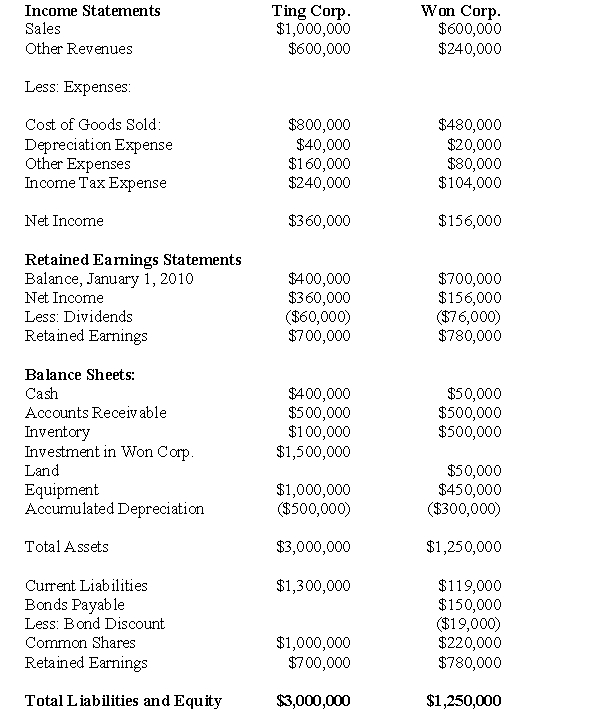

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-What effect would the intercompany bond sale have on Ting?

Definitions:

Internal Labor Markets

Employment systems within a company or organization where workers are hired and promoted based on criteria established internally rather than competing in an external job market.

Labor Market Shelters

Describes economic sectors or employment practices that protect workers from the harshness of the market, often through regulation or unionization.

Senior Personnel

Individuals who hold high-ranking positions within an organization, typically involved in decision-making processes and strategic planning.

Codetermination

A German system of worker participation that allows workers to help formulate overall business strategy. German workers’ councils review and influence management policies on a wide range of issues, including when and where new plants should be built and how capital should be invested in technological innovation.

Q9: For the sake of simplicity,assume that US1's

Q9: Ignoring taxes,what is the total amount of

Q11: The prewriting above is<br>A) focused freewriting.<br>B) brainstorming.<br>C)

Q15: Prepare a Statement of Consolidated Retained Earnings

Q30: Intangible assets with definite useful lives should

Q39: Which of the following rates would be

Q41: Assuming that Keen Inc.purchases 80% of Lax

Q47: Assume that two days after the acquisition,the

Q58: What would be the carrying value of

Q90: Rick is an accountant for MRT Corporation.