inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

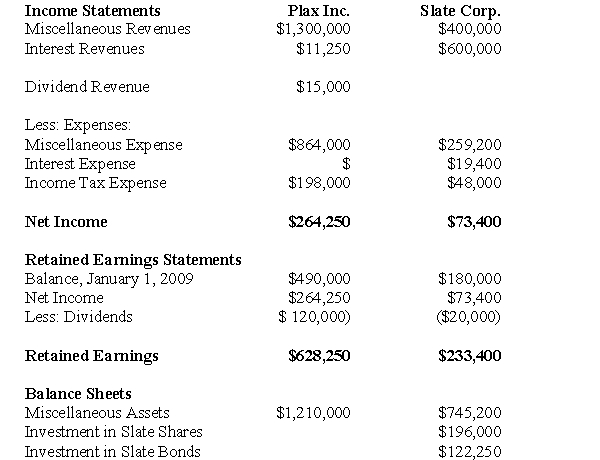

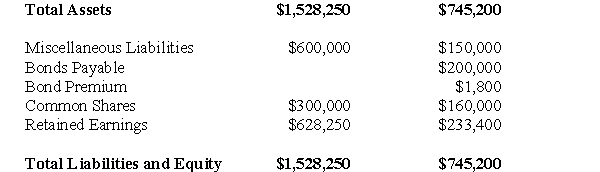

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Prepare a Statement of Consolidated Retained Earnings for the year ended December 31,2003 for Plax Inc.

Definitions:

Not-For-Profit Organization

An organization that operates for purposes other than making a profit, such as charity, education, or social causes.

Strongest Selling Point

A unique feature or aspect that makes a product or service stand out from competitors.

College Graduate

An individual who has completed a course of study at a college or university and received a degree.

Upper-Level Manager

A high-level executive who is responsible for overseeing the strategic direction and decision-making within an organization.

Q7: What is the amount of miscellaneous liabilities

Q9: Which of the following is least likely

Q13: Subject: studying in a group versus studying

Q13: Assume the same facts as Question 62

Q15: Which of the following is/are LEAST likely

Q24: What is the amount of RXN's foreign

Q37: The amount of Non-Controlling Interest on Big

Q40: Company Inc.owns all of the outstanding voting

Q55: A Company owns 80% of the voting

Q57: What is the amount of after-tax profit