The following information pertains to questions

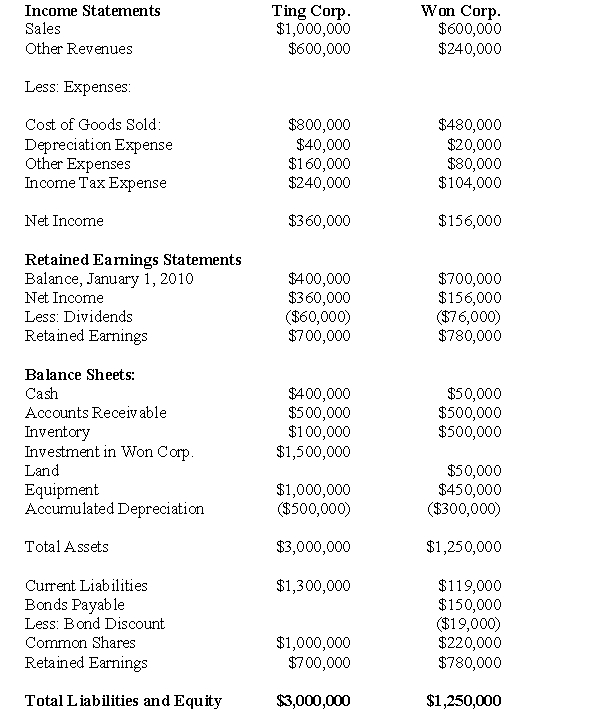

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-What is the amount of unamortized acquisition differential on December 31,2010?

Definitions:

Free Association

A psychoanalytic therapy technique where patients are encouraged to voice thoughts without censorship as they occur.

Hypnosis

State of consciousness in which the person is especially susceptible to suggestion.

Psychoanalytic Method

The psychoanalytic method is a therapeutic approach developed by Sigmund Freud, focusing on exploring unconscious conflicts and motivations through techniques such as free association and dream analysis.

Displacement

A defense mechanism in psychoanalytic theory where an individual shifts their emotional feelings from one object or person to another, often less threatening, one.

Q11: Compute Wilsen's exchange gain or loss for

Q17: ABC invested $30 million in cash

Q24: Which of the following statements is correct?<br>A)IFRS

Q33: Prepare the journal entries for 2011.

Q33: What is the amount of the non-controlling

Q36: Prepare the 2013 journal entries to record

Q95: Consider the following activities which could be

Q104: Suppose you are a newly hired accountant

Q121: Sunk costs are:<br>A)The same as opportunity costs<br>B)Expenditures

Q129: In a regression analysis for estimating a