inclusively.Assume that the Entity Method applies (regardless of the dates used in the problems).

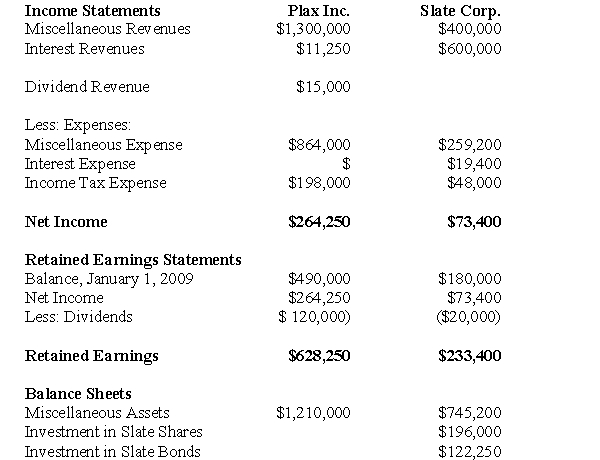

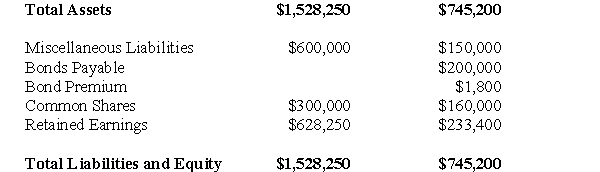

The Financial Statements of Plax Inc.and Slate Corp for the Year ended December 31,2009 are shown below:

Other Information:

Other Information:

Plax acquired 75% of Slate on January 1,2005 for $196,000,when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill.There were impairment losses to the goodwill of $6,400 and $1,600 in 2000 and 2003 respectively.

Plax uses the cost method to account for its investment.

Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31,2012.The bonds were issued at a premium.On January 1,2009 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

On January 1,2009,Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

Both companies are subject to a 40% Tax rate.

Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared.

-Assuming that Plax uses the equity method,prepare a computation showing the balance in Plax's investment in Slate account on December 31,2009.

Definitions:

Lost Productivity

The decrease in the efficiency or output of work due to various factors such as distractions, absenteeism, or inefficiencies.

Ethical Culture

The shared beliefs, practices, customs, and behaviors within an organization that determine what is considered morally right or wrong.

Fraudulent Emails

Unsolicited emails that attempt to deceive recipients into divulging personal, financial, or security information for illicit purposes.

Assumptions

Beliefs or ideas taken for granted without proof.

Q5: Which of the following statements is correct?<br>A)If

Q15: Prepare a Statement of Consolidated Retained Earnings

Q21: Fraudulent financial reporting:<br>I. Is an example of

Q21: Writing a final draft is a task

Q23: X Inc and Y Inc.are virtually identical

Q25: How would the not-for-profit organization report each

Q25: Prepare a schedule of Realized and Unrealized

Q27: Assume that Stanton had other Intangible assets

Q28: What would be the amount appearing on

Q52: Compute the goodwill on the acquisition date.