The following information pertains to questions

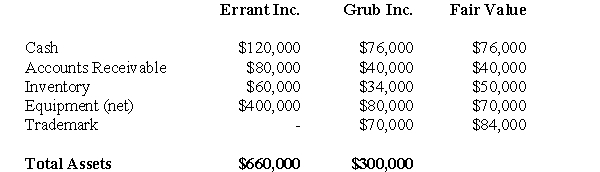

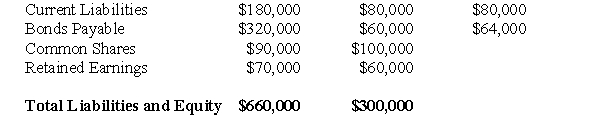

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-How much Goodwill will be carried on Grub's Balance Sheet on December 31,2007?

Definitions:

Private Health Insurance

Health insurance coverage provided by private entities as opposed to government programs, often through employment or individual purchase.

Industrialized Countries

Nations characterized by a significant level of industrial activity, high standards of living, and well-developed infrastructure.

Defensive Medicine

The recommendation by physicians of more tests and procedures than are warranted medically or economically as a way of protecting themselves against later malpractice suits.

Preventive Medicine

The branch of medicine focused on preventing disease and maintaining health, rather than treating illnesses after they develop.

Q2: Prepare a Balance Sheet for Clarke on

Q14: The amount of goodwill arising from this

Q15: The Shareholder Equity section of Parent's Consolidated

Q24: Assume that the following draft balance sheet

Q25: Which of the following is NOT currently

Q36: Accounting information:<br>I. Can be used to guide

Q37: The shareholders of 123 Inc.and 456 Inc.wish

Q38: Ignoring income taxes,what is the amount of

Q45: Consolidated Net Income is equal to<br>A)the sum

Q55: A Company owns 80% of the voting