The following information pertains to questions

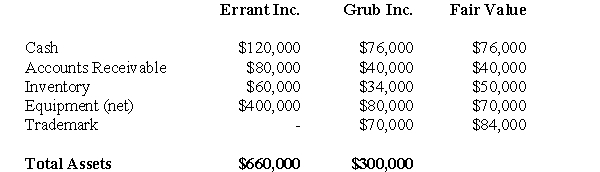

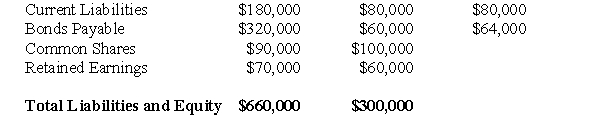

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-The amount of goodwill arising from this business combination is

Definitions:

Reporting Entity

An entity for which there are users who rely on the entity's financial reports for making economic decisions.

Accounting Estimate

Approximations or judgments made by management in preparing financial statements, necessary when a precise value cannot be readily determined.

Retrospective Application Method

A method of applying new accounting policies to transactions, other events, and conditions as if the new policies had always been in place.

Financial Statements

Reports summarizing the financial performance and position of a company, including the income statement, balance sheet, and cash flow statement.

Q1: The SEC made a monumental decision to

Q4: For each pair of sentences, select the

Q14: The CICA Handbook is the handbook of

Q16: Does this paragraph compare, contrast, or both?<br>A)

Q18: Because Andrea fears flying, she travels by

Q25: Types of tests<br>A) multiple-choice test<br>B) math test<br>C)

Q37: Goodwill is:<br>A)the amount paid for the customer

Q42: Which of the following rates would be

Q54: Which of the following rates would be

Q104: The Certified Management Accountants of Canada (CMA)Competency