The following information pertains to questions

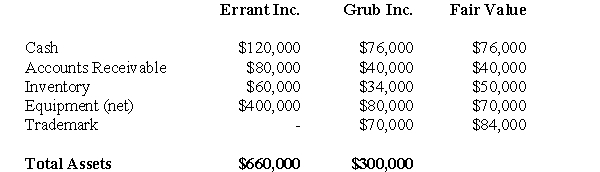

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

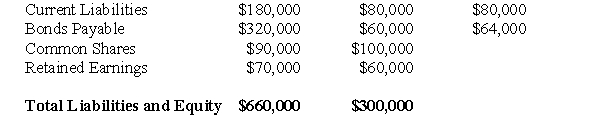

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-What would be Errant's journal entry to record the Acquisition differential (excluding any goodwill impairment)on December 31,2007? Assume that any difference between the fair values and book values of the equipment,trademark and bonds payable would all be amortized over 10 years.

Definitions:

Non-Human Communication

Communication methods observed among animals, plants, and machines, excluding human language and interaction.

Signs

Observable indicators or symptoms of a particular condition or the presence of something.

Critical Differences

Significant or substantial variances between entities or conditions that are of importance to understanding or decision-making.

Prototypes

Original or first models of something from which other forms are copied or developed, often used in the context of designs, technology, or cognition.

Q1: Any excess of fair value over book

Q3: The implied value of a VIE at

Q13: Compute YIN's Goodwill at the date of

Q13: Assume the same facts as Question 62

Q18: In which fund would the receipt of

Q24: Under IFRS 10,when can a venturer recognize

Q28: Explain how the amount was derived for

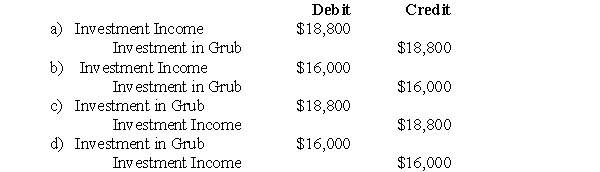

Q29: What would be the journal entry to

Q55: What would be the amount of the

Q56: The amount of Accounts Receivable appearing on