The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

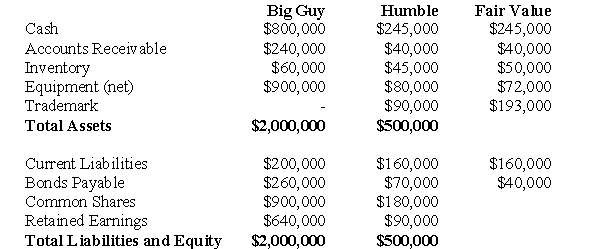

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

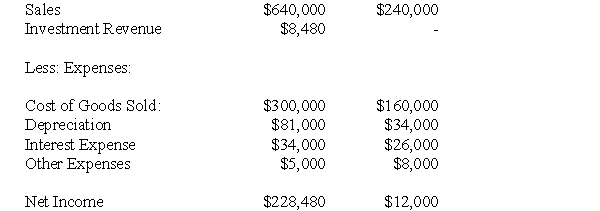

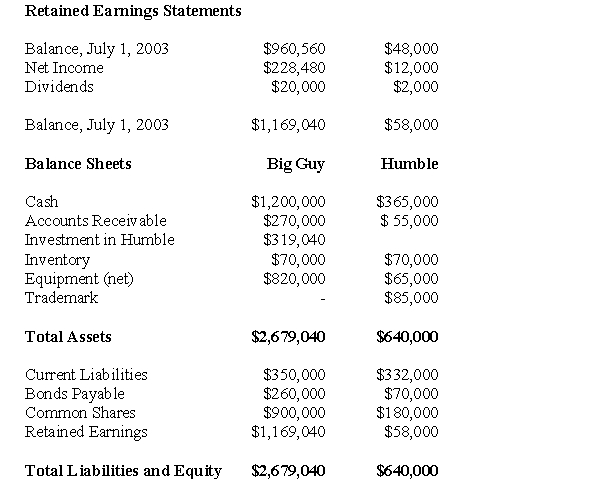

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The NET amount appearing on Big Guy's Consolidated Balance Sheet for equipment as at July 1,2004 would be:

Definitions:

Median

is a statistical measure that represents the middle value in a given set of numbers, dividing the dataset into two equal halves.

Books Read

This term lacks context as a key term but could refer to the number or list of books someone has read, impacting various aspects of cognition and literacy.

Range

The difference between the highest and lowest scores in a distribution.

Central Tendency

A statistical measure that identifies the center of a data set, often using the mean, median, or mode.

Q9: UNI Inc.owns 30% of the outstanding voting

Q18: The skiers dressed their bodies in layers

Q21: Writing a final draft is a task

Q21: Which of the following statements is correct?<br>A)If

Q27: Prepare a detailed calculation of Consolidated Net

Q28: Subject: _ <br>Audience: hikers who don't know

Q31: Section 4430 of the CICA Handbook contains

Q45: What would be the journal entry to

Q58: What amount of sales revenue would appear

Q62: Proofread paragraph 5 for missing words. Select