The following information pertains to questions

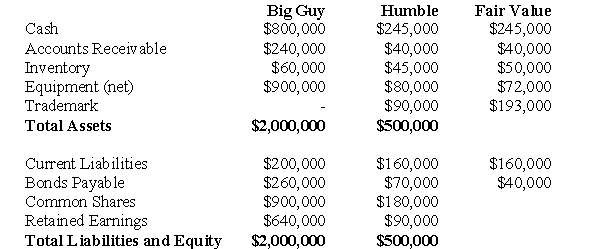

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

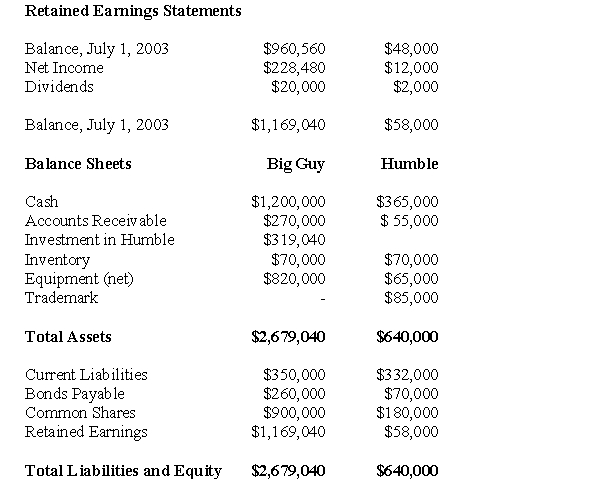

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

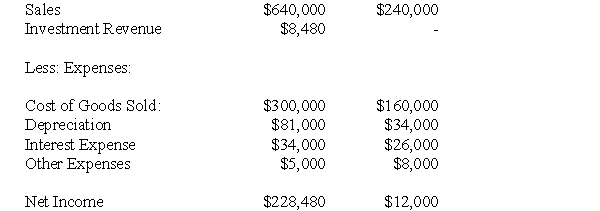

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-What amount of dividends would appear on Big Guy's Consolidated Statement of Retained Earnings as at July 1,2004?

Definitions:

Søren Kierkegaard

A Danish philosopher considered the father of existentialism, known for his critique of Hegel and exploration of individuality, faith, and ethics.

Passions

Strong and barely controllable emotions or desires.

Commitment To God

A deeply personal or communal pledge or devotion to a deity or divine being as part of a religious faith.

Functionalists

Supporters of a theory in sociology and anthropology that interprets society as a structure with interrelated parts designed to meet the biological and social needs of individuals that make up that society.

Q2: For each pair of sentences, select the

Q5: Which of the following statements is correct?<br>A)If

Q23: In which fund would the purchase and

Q31: Which of the following rates would be

Q35: What would be the amount of other

Q36: The amount of net income appearing on

Q41: At what amount (in Canadian Dollars)would the

Q44: Using Push Down accounting is:<br>A)permissible under IFRSs.<br>B)is

Q46: Ignoring taxes,what is the total amount of

Q56: The reporting method used when the Investor