The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

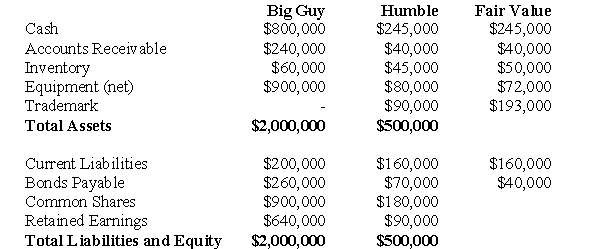

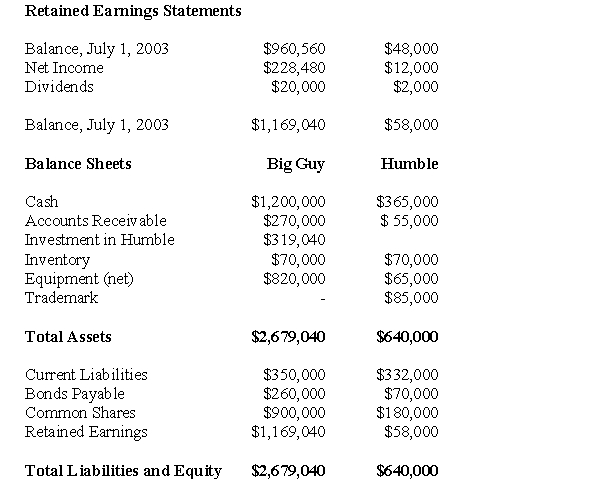

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

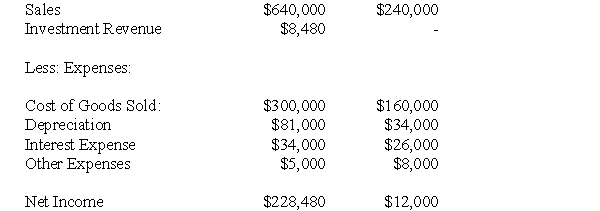

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of other expenses appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Cuticle

Outer, thin layer, usually horny—for example, the outer covering of hair or the growth of the stratum corneum onto the nail.

Medulla

The innermost part of an organ or structure, such as the central region of the kidney or the lower part of the brainstem.

Central Axis

An imaginary line that runs through the center of a body or object, around which the body or object can theoretically rotate.

Medulla

An area at the base of the brainstem that controls vital functions such as heart rate, breathing, and blood pressure.

Q1: Which of the following is NOT a

Q19: What percentage of Marvin's shares was purchased

Q19: On December 31,2011,XYZ Inc.has an account payable

Q20: What is Hanson's ownership interest in Marvin

Q24: The risk exposure resulting from the translation

Q25: According to the CICA Handbook and current

Q41: Goodwill can best be described as:<br>A)The difference

Q41: The amount of interest expense appearing on

Q41: Assuming that Plax uses the equity method,prepare

Q48: Appendix A of IFRS 3 provides an