The following information pertains to questions

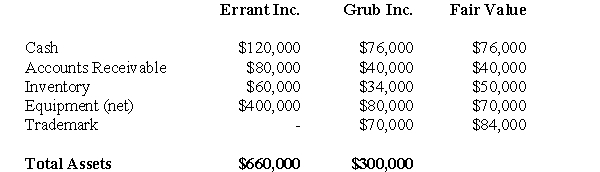

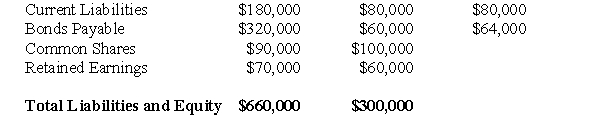

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

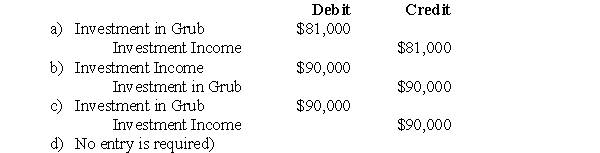

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

-What would be Errant's journal entry to record Grub's Net Income for 2004?

Definitions:

Recognize Material

involves the ability to identify and recall information that has been previously learned or experienced.

Learning

Attainment of fresh comprehension, know-how, practices, beliefs, or tastes via the routes of studying, experiencing, or being taught.

Seventies

The seventies often refer to the decade between 1970 and 1979, characterized by significant social, political, and cultural change.

Recall Material

The act of remembering or retrieving previously learned information.

Q1: What is the topic sentence of the

Q6: Although many people still pursue traditional ways

Q14: Prepare a Balance Sheet for Clarke on

Q25: For each pair of sentences, select the

Q27: Prepare a detailed calculation of Consolidated Net

Q28: Which of the following rates would be

Q29: _. First of all, most people don't

Q32: The following are selected transactions from Helpers

Q56: The reporting method used when the Investor

Q72: On December 31,2011,XYZ Inc.has an account receivable