The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

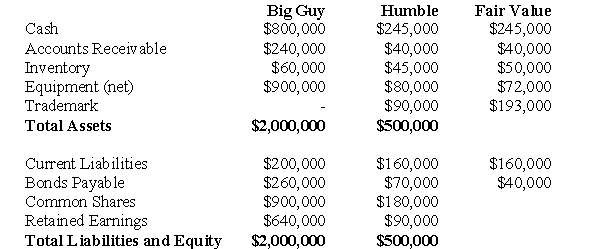

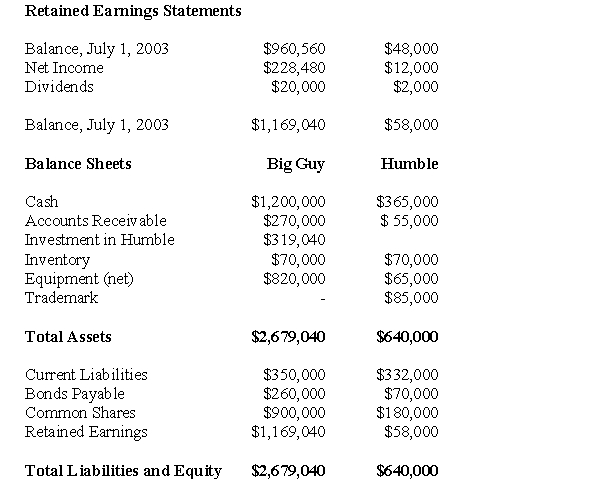

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

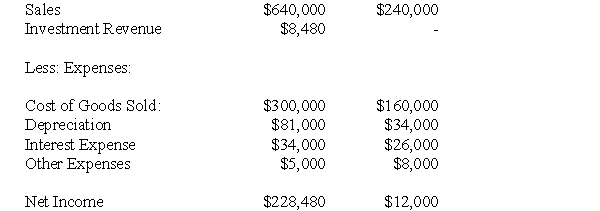

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of interest expense appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Fallacious Forms

Incorrect or misleading arguments that contain errors in reasoning, often used to deceive or persuade others.

Strategic Plan

A method by which an organization deploys its resources to realize a goal.

Organization Resources

The assets, both tangible and intangible, that an organization utilizes to function and achieve its objectives.

Fallacy Of Popular Appeal

A logical fallacy that occurs when an argument is deemed true or false based on its popularity or the number of people who support it.

Q7: How many examples does the writer use

Q9: For each pair of sentences, select the

Q14: For each pair of sentences, select the

Q27: What would be the carrying value of

Q27: What would be the amount of the

Q27: What writing pattern does this paragraph employ?<br>A)

Q34: What would be the carrying value of

Q37: Which of the following rates would be

Q54: Which of the following is NOT a

Q60: What is the required adjustment to ABC's