The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

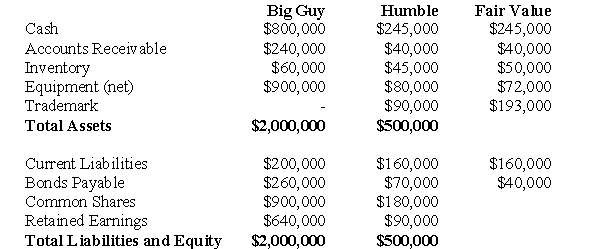

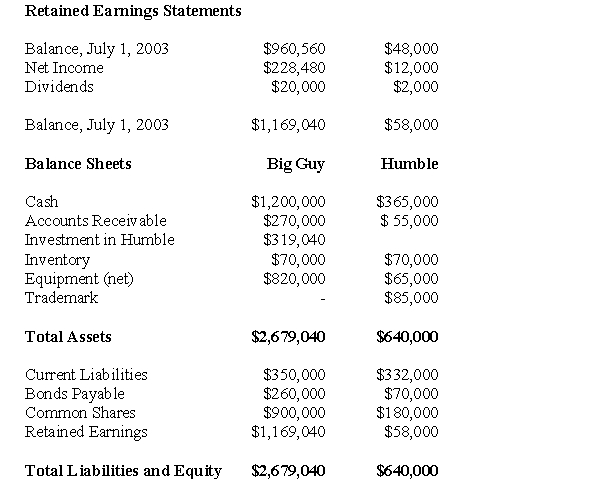

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

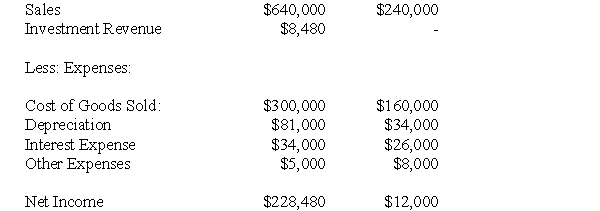

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of other expenses appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Preparation

The act of making ready or being made ready for use or consideration.

Decision-Making Criteria

The standards or factors considered when making a choice or judgment.

Levels of Desire

The varying degrees of eagerness or interest that consumers have towards purchasing or engaging with a product or service.

Win-Win Situation

A scenario in negotiations or deals where all parties involved benefit or achieve their objectives, fostering positive relationships and outcomes.

Q4: Assuming that GNR owned 80% of NXR

Q9: If a not-for-profit organization that usually has

Q10: What is the dominant factor used to

Q14: Prepare a schedule of realized and unrealized

Q19: _. Eggs are a great source of

Q19: What effect would the intercompany bond sale

Q26: What writing pattern does this paragraph employ?<br>A)

Q28: Subject: _ <br>Audience: hikers who don't know

Q42: Dragon Corporation acquired a 7% interest in

Q108: If a manager is deciding whether to