The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

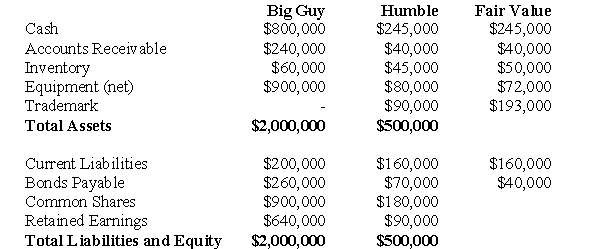

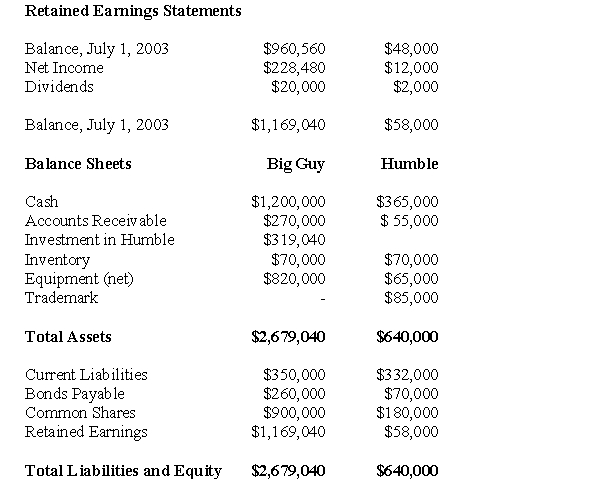

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

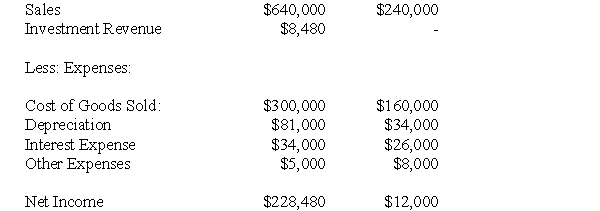

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of non-controlling interest appearing on Big Guy's Consolidated Balance Sheet as at July 1,2004 would be:

Definitions:

Conscious Marketing

Emphasizes ethical considerations and the well-being of stakeholders in the marketing process, aiming for sustainable and socially responsible practices.

Economic Value

The worth of a good or service determined by its utility and scarcity, influencing both cost and price.

Overriding Principles

Fundamental rules or theories that take precedence over others in guiding behavior, decision-making, or policy formulation.

Business Ethics

Refers to a branch of ethical study that examines ethical rules and principles within a commercial context, the various moral or ethical problems that might arise in a business setting, and any special duties or obligations that apply to persons engaged in commerce.

Q4: What is the amount of the foreign

Q18: What would be the gain or loss

Q19: What effect would the intercompany bond sale

Q21: Fraudulent financial reporting:<br>I. Is an example of

Q32: The purpose of this paragraph is to<br>A)

Q36: The subject of this paragraph is<br>A) e-mail.<br>B)

Q36: Under the Current Rate Method:<br>A)Only current balance

Q42: The amount of non-controlling interest in earnings

Q45: Prepare MAX's Consolidated Statement of Financial Position

Q88: Whether a given type of information is