The following information pertains to questions

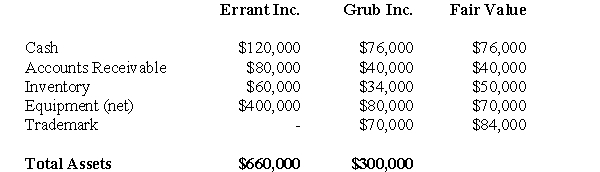

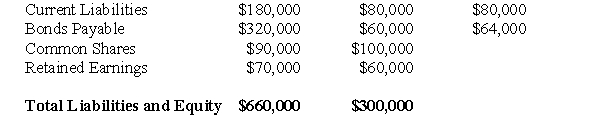

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

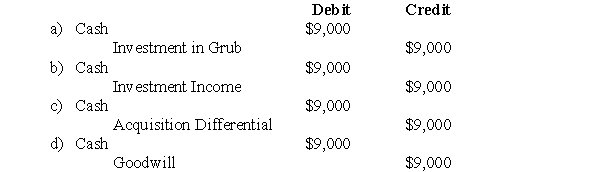

-Assuming that Errant uses the Cost Method,what would be the journal entry to record the dividends received by Errant during the year?

Definitions:

Hormones

Chemical messengers produced by glands in the body that regulate physiological functions and behaviors.

Gender Dysphoria

A psychological condition where a person experiences distress due to a mismatch between their gender identity and their assigned sex at birth.

External Genitals

The visible parts of the genitalia, which in biological males usually includes the penis and scrotum, and in biological females includes the vulva.

Functionalism

A theoretical perspective in sociology and anthropology that interprets society as a structure with interrelated parts designed to meet the biological and social needs of individuals.

Q9: Which of the following is least likely

Q10: What is the amount of the gain

Q17: Which of the following journal entries would

Q27: Assume that Parent Inc.decides to prepare an

Q32: The amount of Retained Earnings appearing on

Q33: What is the amount of the non-controlling

Q38: What would be the amount of the

Q63: What is the total amount of cost

Q76: Which of the following often prevents managers

Q116: John is creating next year's budget for