The following information pertains to Questions

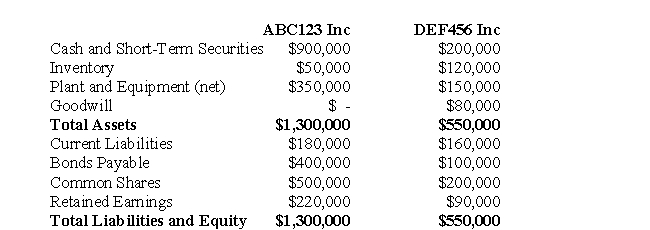

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July1,2008.On the date,the balance sheets of each of these companies were as follows:  On that date,the fair values of DEF456 Assets and Liabilities were as follows:

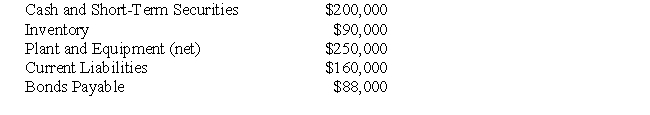

On that date,the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

In addition to the above,an independent appraiser deemed that DEF456 Inc.had trademarks with a fair market value of $100,000 which had not been accounted for.In turn,ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment,which were said to have Fair Market Values of $30,000 and $480,000,respectively.

-Assuming that DEF456's Plant and Equipment was only worth $500,000.Briefly explain how your response to Question 65 would change.Do not prepare Consolidated Financial Statements.

Definitions:

Two-Way Valves

Valves that allow fluid or air to flow in two directions, commonly used in various mechanical and biological systems to control the passage of substances.

Injection Port

A medical device implemented under the skin to allow for easy and repeated access to the bloodstream for the delivery of medication.

Filter

A device or process used to remove contaminants or particles from a substance, such as air or water.

Intake and Output

The measurement and monitoring of fluids consumed and expelled by the body, important in medical care.

Q11: Assume that Parent Inc.decides to prepare an

Q15: Prepare a Statement of Consolidated Retained Earnings

Q17: At what amount (in Canadian Dollars)would RXN's

Q18: The judge _ her decision an hour

Q20: Excluding any goodwill impairment losses,what would be

Q39: What is the amount of cash (in

Q41: If the Investor sells part of its

Q50: Prepare YIN's Consolidated Income Statement for the

Q71: Which of the following methods of accounting

Q73: _<br>A) The surprised man shouted, "I've never