The following information pertains to questions

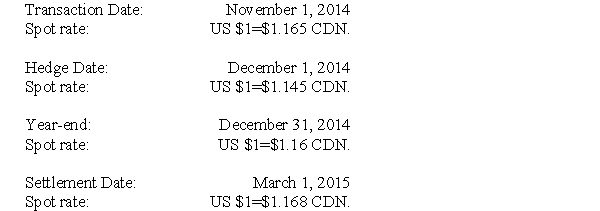

RXN's year-end is on December 31.On November 1,2014 when the U.S.dollar was worth $1.165 CDN,RXN sold merchandise to an American client for $300,000.Full payment of this invoice was expected by January 31,2015.On December 1,the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN.

In order to minimize its Foreign Exchange risk and exposure,RXN entered into a contract with its bank on December 1,2014 to deliver $300,000 U.S.in three months time.The spot rate at year-end was $1.16 CDN.On March 1,2015,RXN received the $300,000 U.S.from its client and settled its contract with the bank.

Significant dates pertaining to this transaction are as follows:

-At what amount (in Canadian Dollars) would RXN's sale be recorded initially?

Definitions:

Q1: The total cost of materials, where the

Q4: Which of the following is the best

Q13: Which of the following statement(s)pertaining to Joint

Q14: Prepare a Balance Sheet for Clarke on

Q18: Parent Company acquires Sub Company's common shares

Q23: Compute Martin's exchange gain or loss for

Q34: The amount of non-controlling interest appearing on

Q48: Using only the Revenue test,which of the

Q49: Assuming that Parent Company purchased 80% of

Q93: A cost function estimated using regression analysis