The following information pertains to Questions

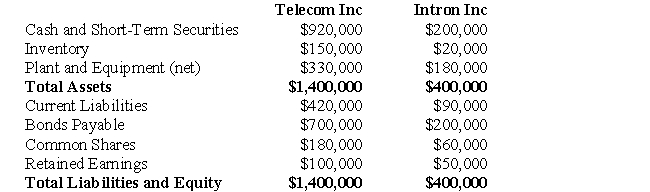

Telecom Inc has decided to purchase the shares of Intron Inc.for $300,000 in Cash on July 1,2009.On the date,the balance sheets of each of these companies were as follows:  On that date,the fair values of Intron's Assets and Liabilities were as follows:

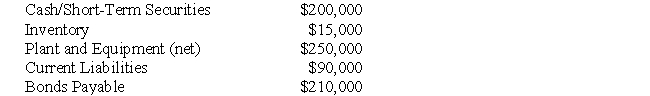

On that date,the fair values of Intron's Assets and Liabilities were as follows:

-Assume that Intron's Assets and Liabilities were purchased instead of its shares for $300,000.Prepare the journal entry to record this purchase.

Definitions:

Deductible

The amount paid out of pocket by the policyholder before an insurance company pays a claim.

Predetermined Amount

A specific quantity or sum set in advance.

Group Insurance

An insurance policy that covers multiple people under one contract, typically offered by employers, associations, or organizations.

Employer

An individual or organization that hires and pays for the services of workers under an expressed or implied contract of employment.

Q2: One common criticism of the Purchase Method

Q16: What is the net Income for the

Q30: What is the amount of unamortized acquisition

Q30: The state of North Carolina contains a

Q35: _<br>A) Never eat oranges, that are green.<br>B)

Q37: The amount of Non-Controlling Interest on Big

Q38: The subject of this paragraph is<br>A) how

Q51: What is the total amount of Unrealized

Q69: Which of the following methods is the

Q136: You certainly _ a hard bargain.<br>A) have