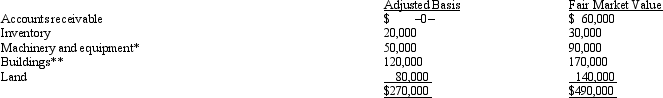

Mr.and Ms.Smith's partnership owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Extraversion

A characteristic that denotes being extroverted, energetic, and favoring engagement with others.

Agreeableness

A personality trait characterized by compassion, cooperativeness, and a harmonious manner with others.

Genetic Makeup

The set of genes or genetic information that an individual inherits from their parents, which contributes to their physical and psychological traits.

Q3: An S corporation with substantial AEP has

Q20: Tom and Terry are equal owners in

Q26: The MBC Partnership makes a § 736(b)cash

Q29: Most practitioners encourage their clients to attend

Q40: The adoption tax credit can be explained

Q62: Which of the following statements is correct?<br>A)A

Q73: Barney,Bob,and Billie are equal partners in the

Q93: Last year,Darby contributed land (basis of $60,000

Q100: A service engineer spends 60% of her

Q102: The property factor includes assets that the