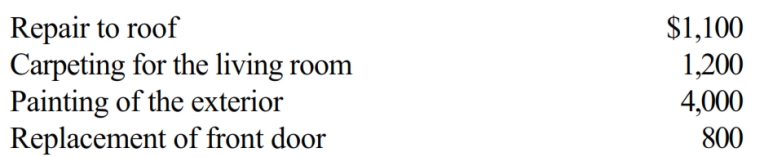

Marvin spends the following amounts on a house he owns:

a. How much of these expenses can Marvin deduct if the house is his principal residence?

b. How much of these expenses can Marvin deduct if he rents the house to a tenant?

c. Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Definitions:

Detectable Symptoms

Observable signs or indications of a disease, disorder, or other condition that can be noticed and identified.

Mutagens

Agents that cause mutations or changes in the DNA of organisms.

Mutations

Changes in the DNA sequence of an organism’s genome, which can lead to variations in physical traits or behavior.

Fatal

Fatal pertains to causing death or leading to a fatal outcome.

Q1: During 2018, Marvin had the following transactions:

Q4: ABC Corporation declared a dividend for taxpayers

Q38: In 2018, Tom is single and has

Q48: Judy paid $40 for Girl Scout cookies

Q79: Brooke works part-time as a waitress in

Q81: Which, if any, of the following expenses

Q82: On August 20, 2018, May placed in

Q140: Briefly discuss the disallowance of deductions for

Q146: Which is not an advantage of a

Q173: During the current year, Doris received a