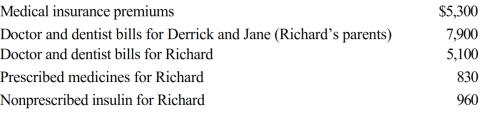

Richard, age 50, is employed as an actuary. For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019. What is Richard's maximum allowable medical expense deduction for 2018?

Definitions:

Blood-Pressure Screening

The measurement of the force of blood against the walls of arteries to identify potential health issues.

Level of Prevention

Refers to the strategies aimed at preventing disease or injury before it occurs (primary), minimizing impact after it does (secondary), or managing long-term effects and rehabilitation (tertiary).

Determinants of Health

Factors that influence an individual's health status, including social, economic, environmental, and genetic factors.

Immigrant

A person who moves to a country other than their native country to live, often for reasons such as employment, better living conditions, or family reunification.

Q5: Unused foreign tax credits can be carried

Q29: Evelyn, a calendar year taxpayer, lists her

Q40: Barb borrowed $100,000 to acquire a parcel

Q44: The work opportunity tax credit is available

Q50: During the year, Green Corporation (a U.S.

Q84: A participant, who is age 38, in

Q85: Under the automatic mileage method, depreciation is

Q101: The § 222 deduction for tuition and

Q203: Stuart owns land with an adjusted basis

Q227: During 2018, Zeke and Alice, a married