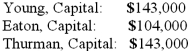

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Young's total share of net income for the second year?

Definitions:

Factory Utilities

The cost of services such as electricity, water, and gas used in the manufacturing process.

Managerial Accounting

Managerial accounting involves the provision of financial data and advice to a company's management for decision-making.

Financial Accounting

The field of accounting focused on the preparation of financial statements for external users, such as investors, creditors, and regulatory agencies.

Economic Events

Economic events are transactions or occurrences that affect the financial position of an entity and can be reliably measured.

Q23: On January 1, 2011, Wakefield City purchased

Q23: Hampton Company is trying to decide whether

Q28: How has the SEC exercised its power

Q29: On March 1, 2011, Mattie Company received

Q39: The executor of the Estate of Kate

Q40: Quadros Inc., a Portuguese firm was acquired

Q52: What is Form 10-K?<br>A) a quarterly report

Q63: A $910,000 bond was issued on October

Q73: GASB Codification Section N50.104 divides all eligibility

Q93: A highly inflationary economy is defined as<br>A)