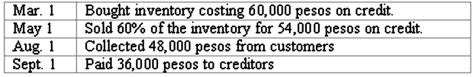

Coyote Corp. (a U.S. company in Texas) had the following series of transactions in a foreign country during 2011:  The appropriate exchange rates during 2011 were as follows:

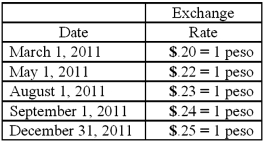

The appropriate exchange rates during 2011 were as follows:  What amount will Coyote Corp. report in its 2011 balance sheet for Accounts receivable?

What amount will Coyote Corp. report in its 2011 balance sheet for Accounts receivable?

Definitions:

Tax

A mandatory financial charge or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Diet Pepsi

A low-calorie carbonated soft drink produced by PepsiCo, branded as a healthier alternative to regular Pepsi.

Beverages

Drinkable liquids excluding water, such as tea, coffee, soda, and alcohol.

Corporate Taxation

The tax levied by governments on the profits earned by corporations, affecting their net income and financial decisions.

Q23: What information needs to be included in

Q32: Cleary, Wasser, and Nolan formed a partnership

Q36: What are the three authoritative pronouncements that

Q57: Webb Company owns 90% of Jones Company.

Q66: Hampton Company is trying to decide whether

Q68: Peter, Roberts, and Dana have the following

Q74: What is shelf registration?<br>A) a procedure that

Q85: How does a foreign currency forward contract

Q93: Perch Co. acquired 80% of the common

Q122: When comparing the difference between an upstream