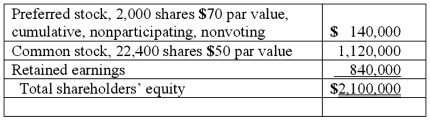

On January 1, 2011, Bast Co. had a net book value of $2,100,000 as follows:  Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co. acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000. Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Definitions:

Public Good

A good or service that is characterized by nonrivalry and nonexcludability. These characteristics typically imply that no private firm can break even when attempting to provide such products. As a result, they are often provided by governments, who pay for them using general tax revenues.

Government

The government refers to the system or group of people governing an organized community, often a state, setting and enforcing laws and policies.

Benefits

The advantages or profits gained from something, including financial, health, or well-being improvements.

Production

The process of creating goods and services through the combination of labor, materials, and technology.

Q7: On January 1, 2010, Jannison Inc. acquired

Q11: Pot Co. holds 90% of the common

Q18: When comparing the difference between an upstream

Q24: The financial statements for Goodwin, Inc., and

Q35: The financial statements for Goodwin, Inc., and

Q47: Direct combination costs and stock issuance costs

Q56: In comparing U.S. GAAP and international financial

Q59: What ownership structure is referred to as

Q92: Walsh Company sells inventory to its subsidiary,

Q102: Kurton Inc. owned 90% of Luvyn Corp.'s