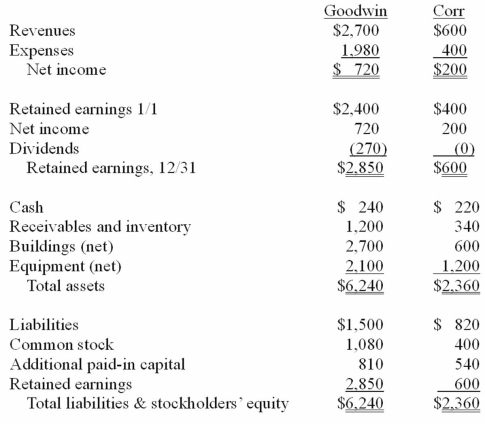

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the goodwill arising from this acquisition at December 31, 20X1.

Definitions:

Stockholders' Equity

Represents the ownership interest of shareholders in a corporation, calculated as total assets minus total liabilities. Also known as shareholder's equity or owner's equity.

Redemption Value

Redemption value is the amount payable to a security holder upon its maturity or the amount to redeem a bond before its maturity.

Dividends in Arrears

Unpaid dividends on cumulative preferred stock that must be paid out before any dividends can be issued on common stock.

Dividends in Arrears

Dividends on preferred stock that have not been paid in the scheduled time but are still owed to shareholders.

Q2: Benjamin was not making progress with achieving

Q8: Articulation refers to<br>A)The motor movements involved in

Q19: Pell Company acquires 80% of Demers Company

Q29: For each of the following numbered situations

Q36: Wilson owned equipment with an estimated life

Q53: McGuire Company acquired 90 percent of Hogan

Q72: Atlarge Inc. owns 30% of the outstanding

Q73: Yules Co. acquired Noel Co. in an

Q100: Carnes has the following account balances as

Q116: Bullen Inc. acquired 100% of the voting