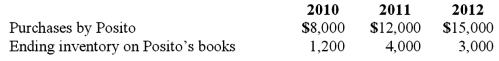

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2011 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2011 consolidation worksheet entry with regard to the unrealized gross profit of the 2010 intra-entity transfer of merchandise?

Definitions:

Nominal Interest Rate

The stated or named interest rate on a loan or investment, not accounting for inflation or compounding effects.

Compounded Monthly

Interest that is calculated and added to the account balance every month.

Periodic Interest Rate

The interest rate charged or paid over a specific period of time, often monthly, quarterly, or annually.

Conditional Sale Contracts

Agreements where the sale of goods or property is conditional upon certain terms, typically the buyer making payments over a period, with the title remaining with the seller until conditions are met.

Q25: Delta Corporation owns 90 percent of Sigma

Q46: Car Corp. (a U.S.-based company) sold parts

Q48: Pell Company acquires 80% of Demers Company

Q63: A parent acquires 70% of a subsidiary's

Q73: Which one of the following is a

Q74: Harrison, Inc. acquires 100% of the voting

Q75: Baker Corporation changed from the LIFO method

Q76: Parent sold land to its subsidiary for

Q81: Caldwell Inc. acquired 65% of Club Corp.

Q82: Johnson, Inc. owns control over Kaspar, Inc.