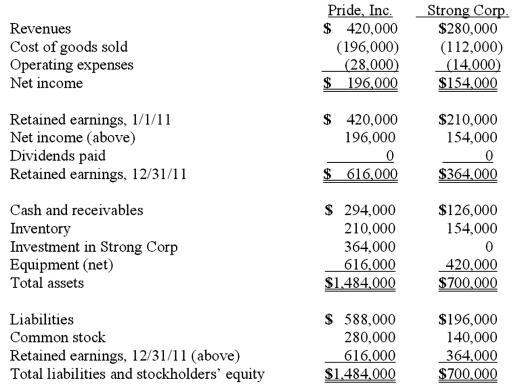

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the consolidated total of non-controlling interest appearing in the balance sheet?

Definitions:

Amino Acids

Organic compounds that serve as the building blocks of proteins, containing both an amino group and a carboxyl group.

Building Blocks

Fundamental components or elements from which something larger is constructed, such as amino acids are for proteins.

Proteins

Large biomolecules or macromolecules consisting of one or more long chains of amino acid residues, crucial for biological processes.

Nucleotide

The basic structural unit of nucleic acids such as DNA and RNA, composed of a sugar, a phosphate group, and a nitrogenous base.

Q7: The financial statements for Goodwin, Inc., and

Q7: On January 1, 2010, Jannison Inc. acquired

Q23: The financial statements for Jode Inc. and

Q42: The financial statements for Goodwin, Inc., and

Q51: Which of the following statements is true

Q62: On October 31, 2010, Darling Company negotiated

Q71: On January 1, 2010, Dawson, Incorporated, paid

Q73: What is meant by unrealized inventory gains,

Q77: Woolsey Corporation, a U.S. company, expects to

Q85: What is the primary accounting difference between