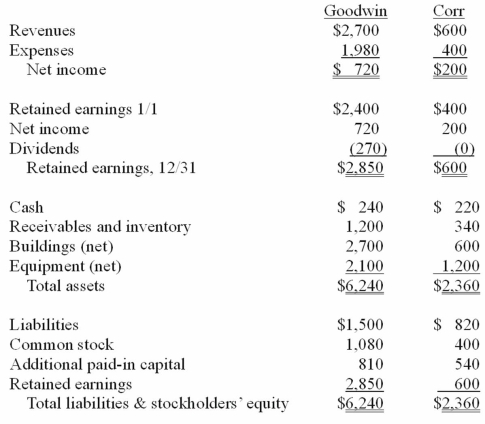

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated receivables and inventory for 20X1.

Definitions:

Q2: How does the use of the equity

Q10: Exemplary clinical practice promotes the concept of

Q17: The financial statements for Goodwin, Inc., and

Q38: The financial statements for Goodwin, Inc., and

Q40: Campbell Inc. owned all of Gordon Corp.

Q55: Parent Corporation acquired some of its subsidiary's

Q68: How would you account for in-process research

Q89: Kaye Company acquired 100% of Fiore Company

Q93: A company has been using the equity

Q121: Racer Corp. acquired all of the common