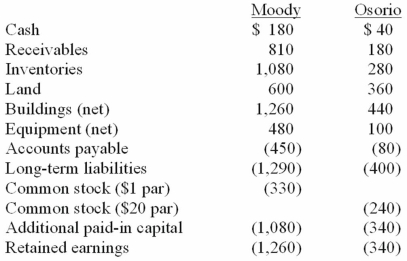

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated equipment at date of acquisition.

Definitions:

Real GDP

Gross Domestic Product adjusted for inflation, measuring the value of goods and services produced by an economy in a given year at constant prices.

GDP Deflator

A measure of the level of prices of all new, domestically produced, final goods and services in an economy relative to the prices in a base year.

Real GDP

Adjusted Gross Domestic Product for inflation to reflect the actual value of goods and services produced in a country.

NASA Project

Refers specifically to the various missions and research initiatives undertaken by the National Aeronautics and Space Administration (NASA), the United States government agency responsible for the nation's civilian space program and for aeronautics and aerospace research.

Q3: Children with Down's Syndrome often present with

Q17: Children with language disorders will acquire literacy

Q17: Slight variations in our genomes that are

Q19: Assisting AAC users to communicate effectively with

Q43: Walsh Company sells inventory to its subsidiary,

Q56: Presented below are the financial balances for

Q56: In comparing U.S. GAAP and international financial

Q85: What is the primary accounting difference between

Q100: How are intra-entity inventory transfers treated on

Q103: Which of the following characteristics is not