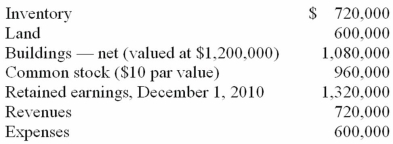

Salem Co. had the following account balances as of December 1, 2010:  Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock.

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock.

Assume that Bellington paid cash of $2.8 million. No stock is issued. An additional $50,000 is paid in direct combination costs.

Required:

For Goodwill, determine what balance would be included in a December 1, 2010 consolidation.

Definitions:

Volleyball Set

In the context of sports, it refers to a group of plays or the equipment used in the game of volleyball, but as a financial term, it's NO.

Markup Percentage

The percentage added to the cost price of goods to cover overhead and profit.

Dollar Amount

a numerical value representing a sum of money.

Direct Material

Raw materials that are directly traceable to the manufacturing of a product and are an integral part of the finished product.

Q3: The overall sequence of language development in

Q3: Following are selected accounts for Green Corporation

Q9: Four-year old Carrie presented with moderate breathy

Q9: All of the swallowing specialists on the

Q11: Thomas Inc. had the following stockholders' equity

Q15: Constructing pedigrees for a family that has

Q50: Yoderly Co., a wholly owned subsidiary of

Q86: Parent Corporation acquired some of its subsidiary's

Q102: Bullen Inc. acquired 100% of the voting

Q108: Fargus Corporation owned 51% of the voting