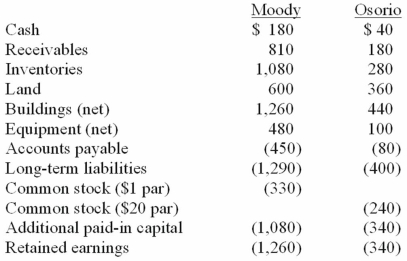

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated land at date of acquisition.

Definitions:

Net Cash Flow

The difference between a company's cash inflows and outflows within a specific period, indicating its overall liquidity.

Working Capital

The difference between a company's current assets and its current liabilities, representing the short-term financial health and operational efficiency of the business.

Salvage Value

The estimated resale value of an asset at the end of its useful life.

Initial Outlay

The upfront expenditure required to start a project, such as purchasing equipment or inventory, crucial for budgeting and financial planning.

Q5: Gene expression refers to the passing on

Q7: J has ALS.He requires an AAC system

Q8: Justin exhibits poor vocabulary comprehension,poor sentence recall

Q13: Carnes has the following account balances as

Q30: The financial balances for the Atwood Company

Q77: On 4/1/09, Sey Mold Corporation acquired 100%

Q78: Matthews Co. acquired all of the common

Q86: Clemente Co. owned all of the voting

Q104: On January 1, 2009, Nichols Company acquired

Q111: Parsons Company acquired 90% of Roxy Company