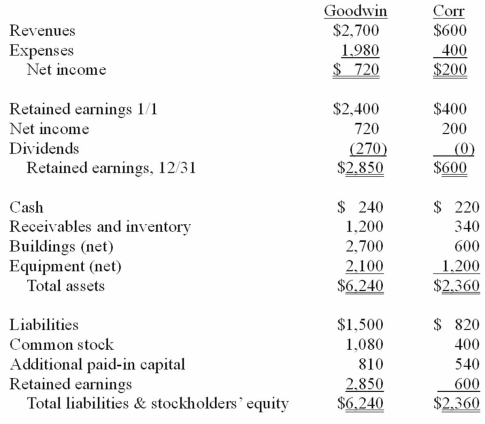

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share. Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated retained earnings at December 31, 20X1.

Definitions:

Younger Volunteers

Individuals of a younger age group who offer their time and services without financial compensation to support various causes and organizations.

Frederick Taylor's Theory

The principles of scientific management, proposed by Frederick Taylor, focusing on improving economic efficiency and labor productivity through systematic study and observation.

Procedures

Established methods or sequences of actions for performing activities or tasks systematically.

People Operating As Machines

The concept of individuals performing tasks in a mechanical or unthinking manner, often applied critically in discussions of labor and productivity.

Q13: Stimulability refers to<br>A)How easily the client can

Q16: Maria has learned to effectively use several

Q17: Phonological processes<br>A)Are rules for combining individual speech

Q41: How would you determine the amount of

Q55: Pell Company acquires 80% of Demers Company

Q66: The balance sheets of Butler, Inc. and

Q67: Beatty, Inc. acquires 100% of the voting

Q100: What is the purpose of the adjustments

Q105: Gargiulo Company, a 90% owned subsidiary of

Q111: Parsons Company acquired 90% of Roxy Company