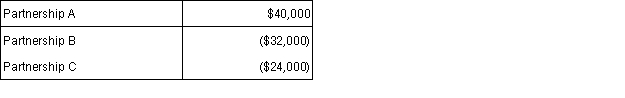

Alice is an attorney and earned $175,000 from her practice in the current year. Alice also owns three passive activities. The activities had the following income and losses:  What is Alice's adjusted gross income for the current year?

What is Alice's adjusted gross income for the current year?

Definitions:

Machine-Hours

A measure of production volume based on the total hours machines are run in the manufacturing process, often used to allocate overhead costs.

Departmental Predetermined Rates

The estimated overhead rates calculated for specific departments within a company to allocate costs appropriately.

Manufacturing Overhead

All indirect factory-related costs incurred during the production process, excluding direct materials and direct labor.

Machine-Hours

A measure of the amount of time machines are utilized during the production process.

Q1: Callie contributes the following assets to a

Q6: A wash sale occurs when a taxpayer

Q8: Employers withhold income tax only on tips

Q17: Bryan, Shahin, and Michele form a partnership.

Q27: Which of the following will disqualify a

Q39: A corporation has a fiscal year-end of

Q53: Operating profit is essentially a measure of

Q63: Residential rental properties are depreciated using the

Q104: A C corporation has a fiscal year-end

Q112: Sole proprietorship means single-person ownership and offers