Adjusting entries

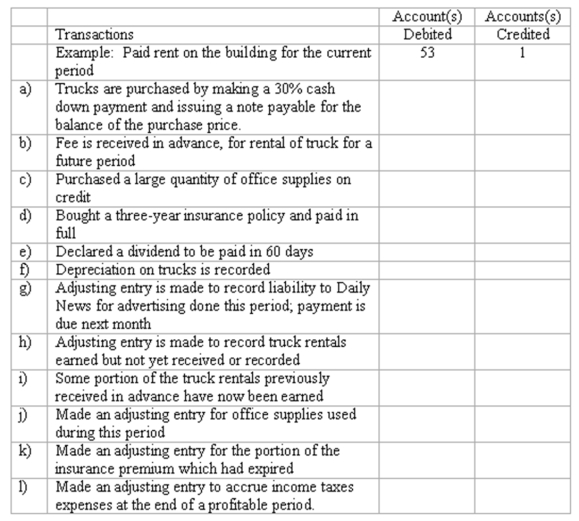

Selected ledger accounts used by Cross Country Truck Rentals, Inc. are listed along with identifying numbers. Following this list of account numbers and titles is a series of transactions. For each transaction, you are to indicate the proper accounts to be debited and credited.

Definitions:

Tariff

A tax imposed by a government on goods and services imported from other countries, aiming to protect domestic industries from foreign competition.

Quota

A government-imposed trade restriction limiting the number or monetary value of goods that can be imported or exported.

Nations Trade

The exchange of goods, services, and capital between countries, driven by comparative advantages and specialization.

Frederic Bastiat

A 19th-century French economist and writer known for his advocacy of classical liberalism and his witty criticisms of protectionism.

Q4: Uncollectible accounts--two methods<br>At the end of the

Q46: The necessary adjustment to Hubbard Transport's accounting

Q50: What is the gross profit?<br>A) $96,800.<br>B) $133,600.<br>C)

Q85: This transaction involves:<br>A) The sale of land

Q93: Adjusting entries<br>Selected ledger accounts used by

Q101: A current asset may be cash or

Q111: Videobusters, Inc. offered books of video rental

Q119: Ben Dryden, president of Jet Glass, Inc,

Q132: The report form of the balance sheet

Q141: Every adjusting entry involves the recognition of