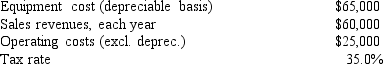

Your new employer, Freeman Software, is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life, and the allowed depreciation rates for such property are 33.33%, 44.45%, 14.81%, and 7.41% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected life.What is the Year 1 cash flow?

Definitions:

Unprepared

The state of not being ready or adequately equipped for a specific task or event.

Confidence

The feeling of self-assurance arising from an appreciation of one's own abilities or qualities.

Linear Formatting

A type of document organization where information is presented in a straight-line sequence from beginning to end.

Nonlinear Formatting

A way of organizing content that does not follow a straight, sequential order, often used in digital media to allow for interactive exploration.

Q10: Julia Saunders is your boss and the

Q13: If management wants to maximize its stock

Q13: Changes in net working capital should not

Q19: After conducting a correlational study between the

Q32: LeCompte Learning Solutions is considering making a

Q39: The use of accelerated versus straight-line depreciation

Q39: The WACC for two mutually exclusive projects

Q54: The CAPM is built on historic conditions,

Q95: Langton Inc.is considering Projects S and L,

Q114: If the price of money (e.g., interest