Instruction 12-12

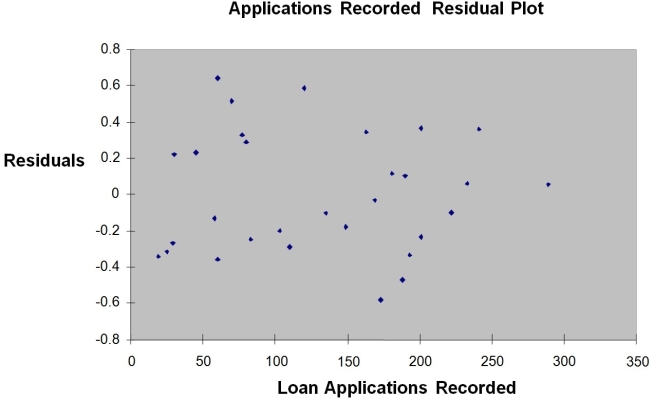

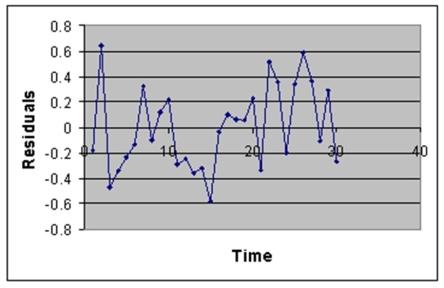

The manager of the purchasing department of a large savings and loan organization would like to develop a model to predict the amount of time (measured in hours)it takes to record a loan application.Data are collected from a sample of 30 days,and the number of applications recorded and completion time in hours is recorded.Below is the regression output:

Note: 4.3946E-15 is 4.3946 x 10-15.

-Referring to Instruction 12-12,there is sufficient evidence that the amount of time needed linearly depends on the number of loan applications at a 1% level of significance.

Definitions:

Tying Contracts

Agreements where the sale of one product (the "tying" product) is conditioned on the purchase of another product (the "tied" product).

Clayton Act

An amendment passed to the U.S. antitrust laws to promote competition among enterprises and protect consumers from unfair business practices.

Clayton Act

A United States antitrust law, passed in 1914, aiming to prevent exclusive sales contracts, corporate mergers, and other practices that restrict competition.

Celler-Kefauver Act

A United States antitrust law passed in 1950, aimed at preventing anti-competitive mergers by closing loopholes relating to asset purchases.

Q85: Referring to Instruction 10-2,the researcher was attempting

Q108: Referring to Instruction 13-5,which of the independent

Q124: Referring to Instruction 14-21,what is the Laspeyres

Q130: Referring to Instruction 12-7,to test whether the

Q132: The statement of the null hypothesis always

Q139: Referring to Instruction 12-8,the value of the

Q146: Referring to Instruction 12-5,the prediction for a

Q154: Referring to Instruction 10-5,at the 0.05 level

Q169: Referring to Instruction 12-9,to test the claim

Q171: Referring to Instruction 14-21,what is the unweighted