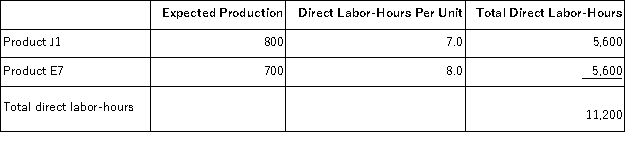

Minon, Inc., manufactures and sells two products: Product J1 and Product E7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $19.90 per DLH. The direct materials cost per unit for each product is given below:

The direct labor rate is $19.90 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

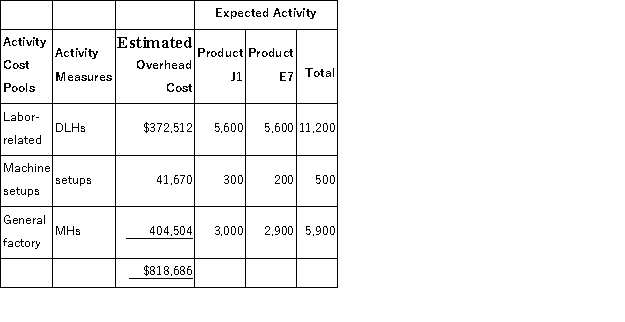

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to:

Definitions:

Reliability

The likelihood that a system or component will perform its required functions for a specified period under stated conditions.

Components

Individual parts or elements that combine or work together within a larger product, system, or mechanism.

Series

A sequence of numbers, objects, or events arranged in a specific order and often following a specific rule.

Parallel

Concurrent or simultaneous; in computing, refers to processes that are executed at the same time.

Q14: Gambino Corporation is a wholesaler that

Q32: Kilduff Corporation's balance sheet and income statement

Q37: Accurso, Inc., manufactures and sells two products:

Q46: Corcetti Company manufactures and sells prewashed denim

Q50: Data concerning Marchman Corporation's single product appear

Q51: When the actual direct labor-hours exceeds the

Q67: All other things the same, an increase

Q95: The nursing station on the fourth floor

Q166: Mahaxay Corporation has provided its contribution format

Q185: In the second-stage allocation in activity-based costing,