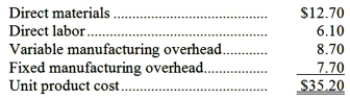

A customer has asked Twiner Corporation to supply 5,000 units of product D05, with some modifications, for $40.20 each. The normal selling price of this product is $52.80 each. The normal unit product cost of product D05 is computed as follows:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product D05 that would increase the variable costs by $3.50 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product D05 that would increase the variable costs by $3.50 per unit and that would require a one-time investment of $23,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Definitions:

Early Experiences

Fundamental events or exposures in the initial stages of life that significantly influence an individual's development and personality.

Controlled Laboratory Conditions

Controlled laboratory conditions refer to an artificial environment created for experimental or research purposes, allowing researchers to isolate variables and examine their effects on negotiations without external influences.

Research Questions

Specific, focused questions that guide academic or scientific inquiry intended to explore and investigate particular subjects or phenomena.

Actual Negotiations

The real, live discussions and bargaining processes where parties aim to reach agreement or compromise.

Q11: When computing the net present value of

Q29: Bubb Corporation has provided the following data

Q36: (Ignore income taxes in this problem.) The

Q53: Paskey Inc. uses a job-order costing system

Q65: (Ignore income taxes in this problem) The

Q96: In the selling and administrative budget, the

Q110: How much factory supervision and indirect factory

Q122: An automated turning machine is the current

Q148: What is the net operating income for

Q194: Under variable costing, fixed manufacturing overhead cost