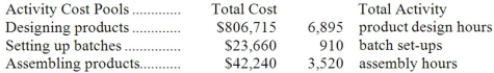

Bubb Corporation has provided the following data from its activity-based costing accounting system:  Required:

Required:

Compute the activity rates for each of the three cost pools. Show your work!

Definitions:

Cost Of Goods Manufactured

The cost of goods manufactured is the total production cost of goods completed during a specific period, including labor, materials, and overhead.

Beginning Finished Goods Inventory

The value of a company's completed products ready for sale at the start of an accounting period.

Cost Of Goods Sold

The total cost directly linked to the production or purchase of goods that have been sold in a period.

Ending Finished Goods Inventory

The value of products available for sale at the end of an accounting period, after all manufacturing costs are accounted for.

Q2: (Ignore income taxes in this problem.) How

Q21: If the company bases its predetermined overhead

Q25: Madson Corporation uses an activity-based costing system

Q42: The practice of assigning the costs of

Q53: The total amount of overhead cost allocated

Q86: Under absorption costing, the ending inventory for

Q121: How much overhead cost is allocated to

Q135: The break-even point in unit sales is

Q185: What is the company's degree of operating

Q193: A properly constructed segmented income statement in