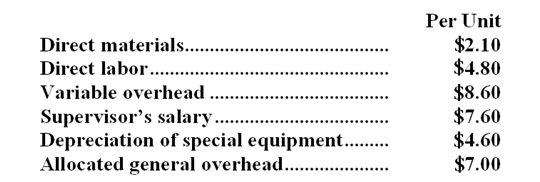

Meltzer Corporation is presently making part O13 that is used in one of its products. A total of 3,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $27.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $3,000 of these allocated general overhead costs would be avoided.

-In addition to the facts given above,assume that the space used to produce part O13 could be used to make more of one of the company's other products,generating an additional segment margin of $26,000 per year for that product.What would be the impact on the company's overall net operating income of buying part O13 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Journal

A book or digital record where all financial transactions are initially recorded in chronological order before being posted to accounts in the ledger.

Debit

A bookkeeping record that leads to either a rise in assets or a fall in liabilities in a firm's balance sheet.

Note Payable

An official pledge in writing to return a specified sum of cash, often with added interest, on a set future date.

Ledger

A book or digital record where financial transactions are entered, tracking the changes in each account associated with those transactions.

Q18: The activity rate for the Order Filling

Q46: If the budgeted direct labor cost for

Q63: Brace Corporation uses direct labor-hours in its

Q89: Kempler Corporation processes sugar cane in batches.

Q90: How much cost, in total, would be

Q92: Dowan Company uses a predetermined overhead rate

Q96: What would be the total overhead cost

Q110: What is the unit product cost for

Q112: (Ignore income taxes in this problem.) Rogers

Q135: Spring Company has invested $20,000 in a