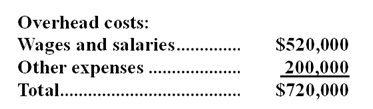

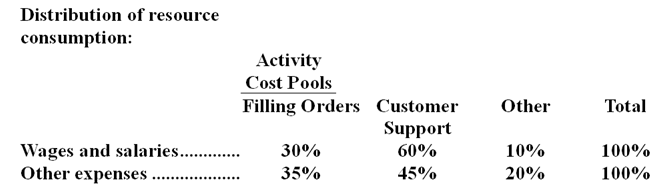

Escher Company is a wholesale distributor that uses activity-based costing for all of its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

-What would be the total overhead cost per order according to the activity based costing system? In other words,what would be the overall activity rate for the filling orders activity cost pool? (Round to the nearest whole cent. )

Definitions:

Fair Value Adjustments

Modifications made to the reported value of assets or liabilities to reflect their actual market value.

Business Combination

This occurs when two or more businesses come together to form a single company, often through acquisitions or mergers.

Recording Method

A system or standard procedure for capturing financial transactions and events in an organization's accounting records.

Unrecorded Liability

A liability that has not been accounted for or documented in the financial statements.

Q5: (Ignore income taxes in this problem.) Judy

Q9: What is the product margin for Product

Q15: (Ignore income taxes in this problem.) The

Q21: Ring Corporation uses a discount rate of

Q26: What is the net operating income for

Q71: What is the total period cost for

Q79: If Store G sales increase by $40,000

Q85: Avitia Inc. bases its manufacturing overhead budget

Q89: In preference decisions, the profitability index and

Q156: What is the total period cost for