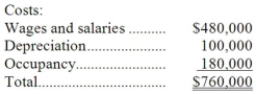

Madson Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

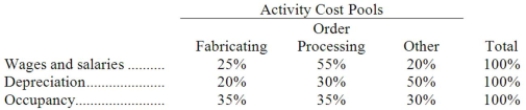

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

Definitions:

Q7: A continuous (or perpetual) budget:<br>A)is prepared for

Q19: The management of Griswell Corporation would like

Q51: The manufacturing overhead budget at Latronica Corporation

Q86: Zollars Cane Products, Inc., processes sugar cane

Q92: (Ignore income taxes in this problem.) Verdin

Q94: Vertical integration is the involvement by a

Q99: If Store Q sales increase by $30,000

Q101: Demora Corporation's activity-based costing system has three

Q117: How much overhead cost is allocated to

Q150: What would the selling price per unit