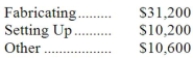

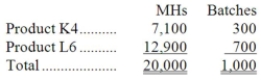

Demora Corporation's activity-based costing system has three activity cost pools-Fabricating, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:  Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Fabricating cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:  Required:

Required:

Calculate activity rates for each activity cost pool using activity-based costing.

Definitions:

Partnership Agreement

A legal document that specifies the rights, responsibilities, and share of profits and losses among the partners in a business venture.

Authority

The legal power or right given to an individual or entity to make decisions, conduct transactions, or enforce rules and regulations.

Remedies

Legal means for enforcing a right or redressing a wrong, including monetary damages, injunctions, and specific performance.

Downtown Office Supply

A business specializing in providing office supplies and equipment, typically located in a city's downtown area.

Q5: The management of Chaloux Corporation would like

Q15: Schmeider Corporation uses the following activity rates

Q27: The following monthly data are available for

Q40: If the internal rate of return is

Q70: Mccance Corporation has an activity-based costing system

Q82: The costs of a particular department should

Q83: The segment margin for Product T was:<br>A)$45,000<br>B)$85,000<br>C)$(10,000)<br>D)$80,000

Q97: A customer has requested that Inga Corporation

Q109: Over an extended period of time in

Q141: (Ignore income taxes in this problem.) A