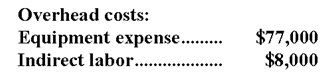

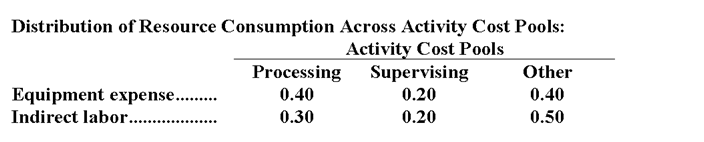

Encarnacion Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:

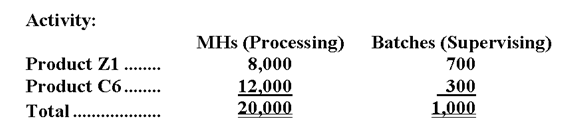

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

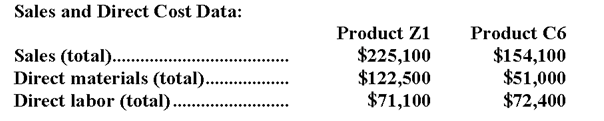

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.

-What is the product margin for Product C6 under activity-based costing?

Definitions:

Comprehensive Tax Allocation

A method of accounting that allows for the recognition of deferred tax liabilities and assets for future tax consequences of events that have been recognized in a business's financial statements or tax returns.

Deferred Method

A method of accounting where certain revenues or expenses are not recognized in the period they occur but are deferred to a later period.

Asset/Liability Method

An accounting technique used for measuring the deferred tax liabilities and assets by considering the temporary differences between the accounting and tax values of assets and liabilities.

Q4: Blanding Company is considering several investment proposals,

Q7: Suppose an action analysis report is prepared

Q39: Fillip Corporation makes 4,000 units of part

Q53: The total annual cash inflow from this

Q114: How much overhead cost is allocated to

Q121: How much overhead cost is allocated to

Q149: The following information pertains to Clove Co.:

Q190: Fellner Corporation produces a single product and

Q192: The contribution margin in dollars for Product

Q230: Data concerning Runnells Corporation's single product appear