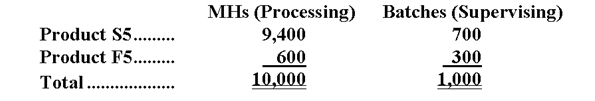

Umanzor Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $42,700; Supervising, $26,900; and Other, $17,400. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-What is the overhead cost assigned to Product S5 under activity-based costing?

Definitions:

Common Stock

Equity securities that represent ownership in a corporation, providing voting rights and a share in the company's profits through dividends.

Treasury

Refers to the department within a government or organization that is responsible for managing the institution's revenue, spending, and debt.

IFRS

International Financial Reporting Standards (IFRS) are a set of accounting standards developed by the International Accounting Standards Board (IASB) that aim to bring consistency to accounting language, practices, and statements globally.

Reserves

Funds or assets set aside to cover future expenses, losses, or liabilities.

Q1: Designing a new product is an example

Q6: Peluso Company, a manufacturer of snowmobiles, is

Q19: Kinstle Inc. uses job-order costing. In September,

Q34: Burghardt Inc. uses a job-order costing system

Q41: Part E43 is used in one of

Q51: What is the net monetary advantage (disadvantage)

Q56: The management of Heider Corporation is considering

Q74: What is the product margin for Product

Q171: On a CVP graph for a profitable

Q189: Krasnow Inc., which produces a single product,