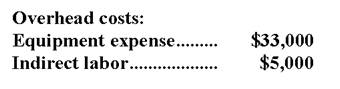

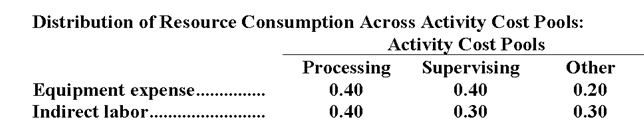

Ollivier Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:

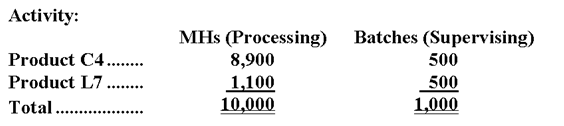

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

Definitions:

Incentive Pay

Compensation awarded to employees to motivate them towards higher performance and efficiency, often linked to achievements or goals.

Financial Benefits

Monetary-based benefits provided to employees, such as insurance, retirement plans, bonuses, and salary increases.

Shareholders

Individuals or entities that own one or more shares of stock in a public or private corporation, having a financial interest in the company's performance.

Team Awards

Recognition given to a group of people for their collective performance or achievements in a particular project or area of work.

Q4: Krasnow Inc. ,which produces a single product,has

Q8: Kapoor Corporation uses the following activity rates

Q24: The selling price of Bayard Corporation's only

Q29: The net operating income in the flexible

Q30: How much cost,in total,would be allocated in

Q45: If the budgeted direct labor time for

Q63: The contribution margin in dollars for Product

Q68: The break-even point in unit sales increases

Q94: The desired ending inventory of Jurislon for

Q192: The medical supplies in the flexible budget