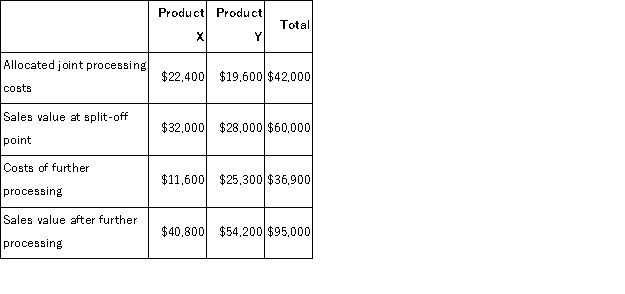

Iaci Company makes two products from a common input.Joint processing costs up to the split-off point total $42, 000 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  Required:

Required:

a.What is the net monetary advantage (disadvantage)of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage)of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

Q4: (Ignore income taxes in this problem. )Pro-Mate,

Q7: Which of the following costs should not

Q8: Cashan Corporation makes and sells a product

Q12: Moyle Corporation has provided the following data

Q14: Under conventional absorption costing, the fixed costs

Q19: (Ignore income taxes in this problem. )Crockin

Q42: Beland Inc.uses a job-order costing system in

Q111: In a factory operating at capacity, not

Q161: Iaci Company makes two products from a

Q170: Eliminating nonproductive processing time is particularly important