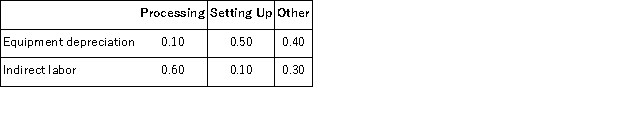

Loader Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other.The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Equipment depreciation totals $88, 000 and indirect labor totals $1, 000.Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Sleeping Patterns

The habitual timing, duration, and quality of sleep, which can influence overall health and well-being.

Stages Of Childbirth

The three phases during labor and delivery, starting from contractions, through delivery of the baby, to the delivery of the placenta.

Preterm Babies

Infants born before completing the usual 37 weeks of gestation, often requiring special medical care due to their undeveloped bodies and organs.

Treatment Options

Various methods and interventions available for diagnosing, managing, or curing diseases and injuries.

Q57: Malan Corporation has provided the following data

Q59: The internal rate of return is computed

Q61: All other things the same, in periods

Q90: (Ignore income taxes in this problem. )The

Q97: Lasorsa Corporation manufactures a single product.Variable costing

Q98: Lafoe Corporation produces two intermediate products, A

Q119: (Ignore income taxes in this problem. )Hinck

Q127: (Ignore income taxes in this problem. )The

Q132: (Ignore income taxes in this problem. )Mark

Q141: Hermenegildo Corporation is presently making part P42