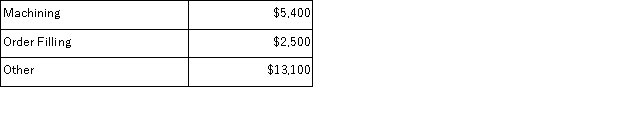

Stroth Corporation uses activity-based costing to compute product margins.Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other.The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:

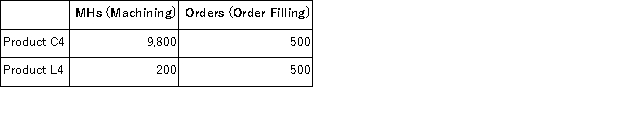

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

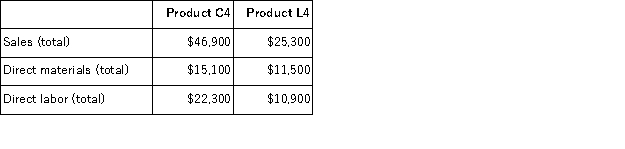

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.  The activity rate for Machining under activity-based costing is closest to:

The activity rate for Machining under activity-based costing is closest to:

Definitions:

Expenses

Costs incurred in the process of earning revenue, including operational, administrative, and marketing costs.

Total Stockholders' Equity

The total value of a corporation's equity owned by shareholders, synonymous with stockholders' equity but emphasizes the aggregation.

Retained Earnings

The part of the net earnings kept by the company instead of being paid out to shareholders as dividends.

Common Stock

A type of equity security that represents ownership in a corporation, granting holders the right to vote at shareholder meetings and receive dividends.

Q12: (Ignore income taxes in this problem. )Clairmont

Q27: The net present value and internal rate

Q37: Munar Corporation uses activity-based costing to compute

Q41: Feltman Inc.uses a job-order costing system in

Q58: Glassey Corporation uses activity-based costing to assign

Q70: Feltman Inc.uses a job-order costing system in

Q78: (Ignore income taxes in this problem. )Carlson

Q90: Peterson Corporation produces a single product.Data from

Q130: Rede Inc.manufactures a single product.Variable costing net

Q163: The degree of operating leverage in a