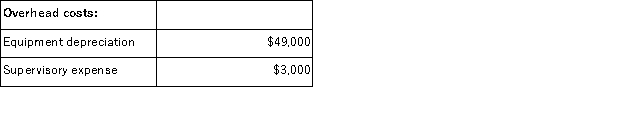

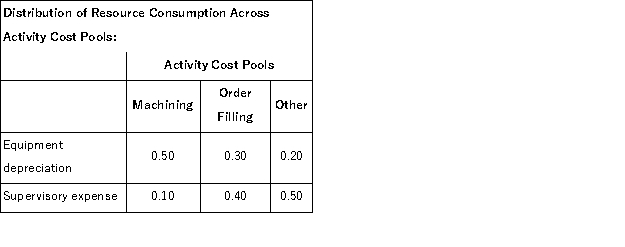

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

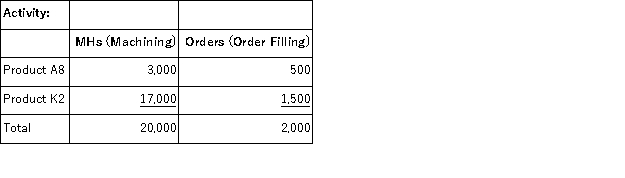

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Q19: Joint products are products that are sold

Q39: (Ignore income taxes in this problem. )The

Q40: Quinnett Corporation has two divisions: the Export

Q99: Kenrick Corporation uses activity-based costing to compute

Q102: Futter Corporation uses an activity-based costing system

Q104: Bevans Corporation is considering a capital budgeting

Q124: Tullius Corporation has received a request for

Q137: Batch-level activities are performed each time a

Q153: (Ignore income taxes in this problem. )Chee

Q176: When using segmented income statements, the dollar